Personal Loans Canada Things To Know Before You Buy

Wiki Article

More About Personal Loans Canada

Table of ContentsHow Personal Loans Canada can Save You Time, Stress, and Money.The Personal Loans Canada IdeasExamine This Report about Personal Loans CanadaSome Of Personal Loans CanadaMore About Personal Loans Canada

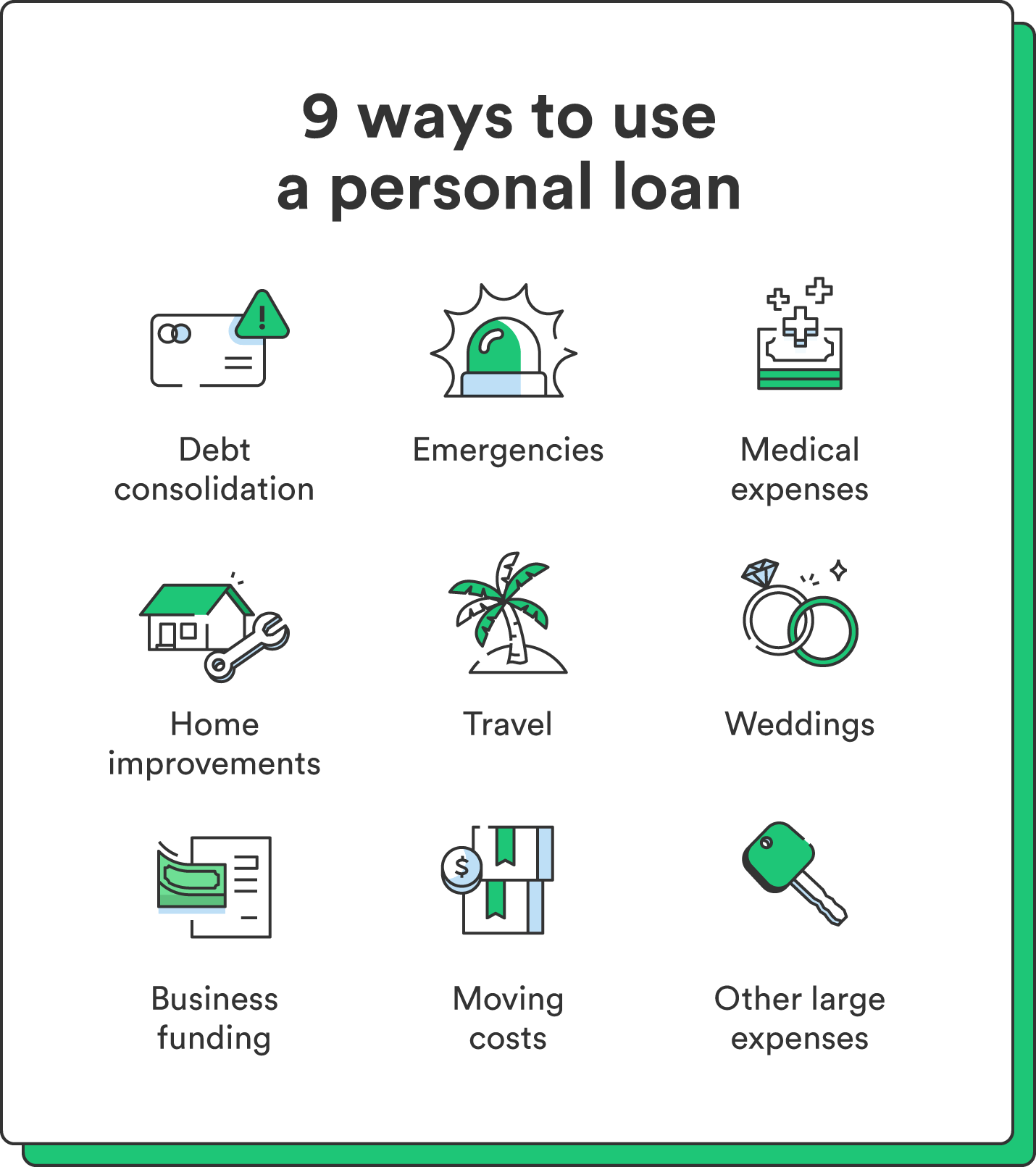

Settlement terms at many personal financing lenders range in between one and 7 years. You get all of the funds simultaneously and can use them for almost any type of function. Customers usually utilize them to fund a possession, such as a lorry or a watercraft, settle financial obligation or assistance cover the cost of a major cost, like a wedding event or a home remodelling.

A set rate gives you the protection of a predictable monthly payment, making it a preferred option for consolidating variable price credit cards. Settlement timelines differ for personal loans, yet consumers are frequently able to pick payment terms in between one and 7 years.

What Does Personal Loans Canada Do?

The charge is generally subtracted from your funds when you finalize your application, minimizing the quantity of cash money you pocket. Personal fundings prices are a lot more straight tied to short term rates like the prime rate.You might be supplied a reduced APR for a much shorter term, because loan providers recognize your balance will certainly be settled much faster. They might charge a greater rate for longer terms knowing the longer you have a lending, the more probable something could transform in your finances that can make the repayment unaffordable.

A personal funding is also a great option to making use of bank card, since you borrow money at a set rate with a precise benefit date based upon the term you choose. Remember: When the honeymoon mores than, the monthly settlements will certainly be a suggestion of the cash you invested.

7 Easy Facts About Personal Loans Canada Described

Prior to taking on debt, utilize a personal loan repayment calculator to help spending plan. Collecting quotes from numerous lending institutions can aid you identify the finest offer and possibly save you rate of interest. Contrast rates of interest, More Bonuses fees and loan provider track record prior to applying for the funding. Your credit history is a big variable in determining your eligibility for the loan in addition to the rates of interest.Prior to using, recognize what your score is to make sure that you recognize what to anticipate in regards to prices. Watch for covert costs and penalties by reading the lender's terms web page so you do not wind up with much less cash money than you need for your monetary goals.

Individual fundings need proof you have the credit rating profile and revenue to settle them. Although they're easier to get than home equity financings or various other secured loans, you still require to show the loan provider you have the ways to pay the funding back. Personal lendings are far better than charge card if you desire a set month-to-month payment and need every one of your funds simultaneously.

Some Known Details About Personal Loans Canada

Credit scores cards may also provide rewards or cash-back options that personal car find out loans don't.Some lenders may also bill costs for personal finances. Personal car loans are car loans that can cover a variety of personal expenses. You can discover personal car loans with banks, lending institution, and online loan providers. Personal finances can be safeguarded, indicating you need collateral to borrow money, or unsecured, without any security required.

As you spend, your available debt is minimized. You can then increase available credit rating by making a settlement towards your credit line. With a personal finance, there's typically a set end date whereby the loan will certainly be settled. A line of credit, on the various other hand, might continue to be open and available to you forever as long as your account remains in great standing with your lending institution - Personal Loans Canada.

The cash received on the financing is not strained. If the loan provider forgives the car loan, it is taken into consideration a canceled financial debt, and that quantity can be strained. Individual financings may be secured or unsecured. A safeguarded personal lending needs some type of security as a problem of borrowing. You might secure an individual financing with cash properties, such as a cost savings account or certification of deposit (CD), or with a physical asset, such as your vehicle or watercraft.

Not known Incorrect Statements About Personal Loans Canada

official websiteAn unsafe individual finance needs no collateral to obtain cash. Financial institutions, credit rating unions, and online loan providers can use both secured and unsecured personal car loans to certified customers. Financial institutions usually think about the latter to be riskier than the former since there's no security to collect. That can mean paying a higher rate of interest for a personal loan.

Once more, this can be a financial institution, debt union, or online individual finance lending institution. If accepted, you'll be given the lending terms, which you can approve or turn down.

Report this wiki page